Life Insurance Isn’t Just for the Elderly—It’s for the Prepared

Life insurance is one of those things many people avoid talking about until it’s too late. But here’s the truth: Life insurance isn’t just about death—it’s about protecting life, legacy, and peace of mind. Whether you’re single, raising a family, or launching a business, having a policy in place can be one of the smartest and most selfless decisions you ever make.

Let’s break it down.

🔍 What Is Life Insurance?

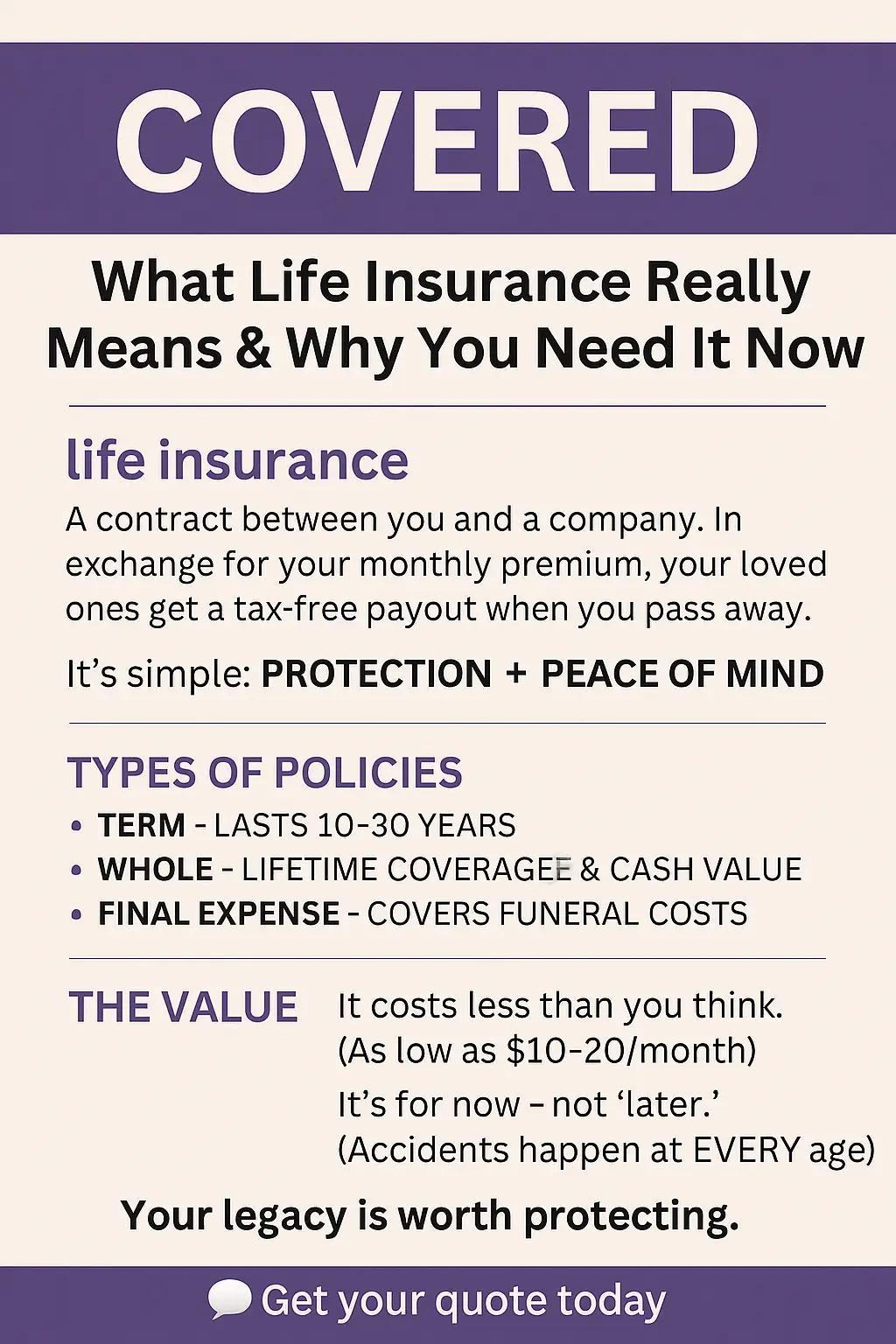

Definition: Life insurance is a contract between you and an insurance company. In exchange for monthly or annual payments (called premiums), the insurer agrees to pay a set amount of money (called a death benefit) to your chosen beneficiaries when you pass away.

🧠 Key Terms You Should Know

- Premium: The amount you pay regularly to keep your policy active.

- Beneficiary: The person(s) who will receive the money after your passing.

- Death Benefit: The lump sum of money paid out by the insurance company.

- Policyholder: The person who owns the insurance policy.

- Term Insurance: Coverage for a set number of years (e.g., 10, 20, or 30).

- Whole Life Insurance: Permanent coverage that lasts a lifetime and often builds cash value.

🤔 Do I Even Need Life Insurance?

Ask yourself:

- Do you have children or dependents?

- Would someone be financially impacted by your death?

- Do you have debt (like a mortgage, car loan, or student loans)?

- Do you want to leave something behind for your family or business?

If you answered yes to ANY of these, then yes—you need life insurance.

📊 Types of Life Insurance Explained

1. Term Life Insurance

- Simple, affordable, temporary.

- Great for younger families or first-time policyholders.

- Example: $25/month for $250,000 in coverage for 20 years.

2. Whole Life Insurance

- More expensive, but lasts forever.

- Builds cash value you can borrow against.

- Often used for legacy planning or as part of wealth building.

3. Final Expense Insurance

- Meant to cover funeral costs and small debts.

- Easier to qualify for, even with health issues.

- Smaller benefit amounts ($5K–$25K).

💡 What Makes Life Insurance Affordable?

- Your age

- Your health

- The amount of coverage you want

- The type of policy you choose

The younger and healthier you are, the more affordable your premium will be.

💬 Common Myths Debunked

- “I’m too young to need it.” Truth: That’s actually the BEST time to get it—rates are lower!

- “It’s too expensive.” Truth: Most people can get basic coverage for less than a monthly dinner out.

- “I’ll just leave savings.” Truth: Savings can be used up quickly. Life insurance pays out immediately.

✅ How to Get Started

- Know what you want the policy to cover (debts, burial, income replacement).

- Choose between term, whole, or final expense.

- Talk to a licensed professional (like me!).

- Get a quote and apply—it’s faster and easier than you think.

🎯 Final Thoughts

Life insurance is love in action. It says, “I care enough to plan ahead.” Whether you’re protecting your children, your spouse, or your peace of mind, there’s a policy designed to fit your life.

Want to chat about your options or book a $10 info session?

📧 Email: info@skillsetsuccesses.com

📲 Or visit: https://paperbell.me/jacque-edwards-

Discover more from The Growth Blueprint

Subscribe to get the latest posts sent to your email.