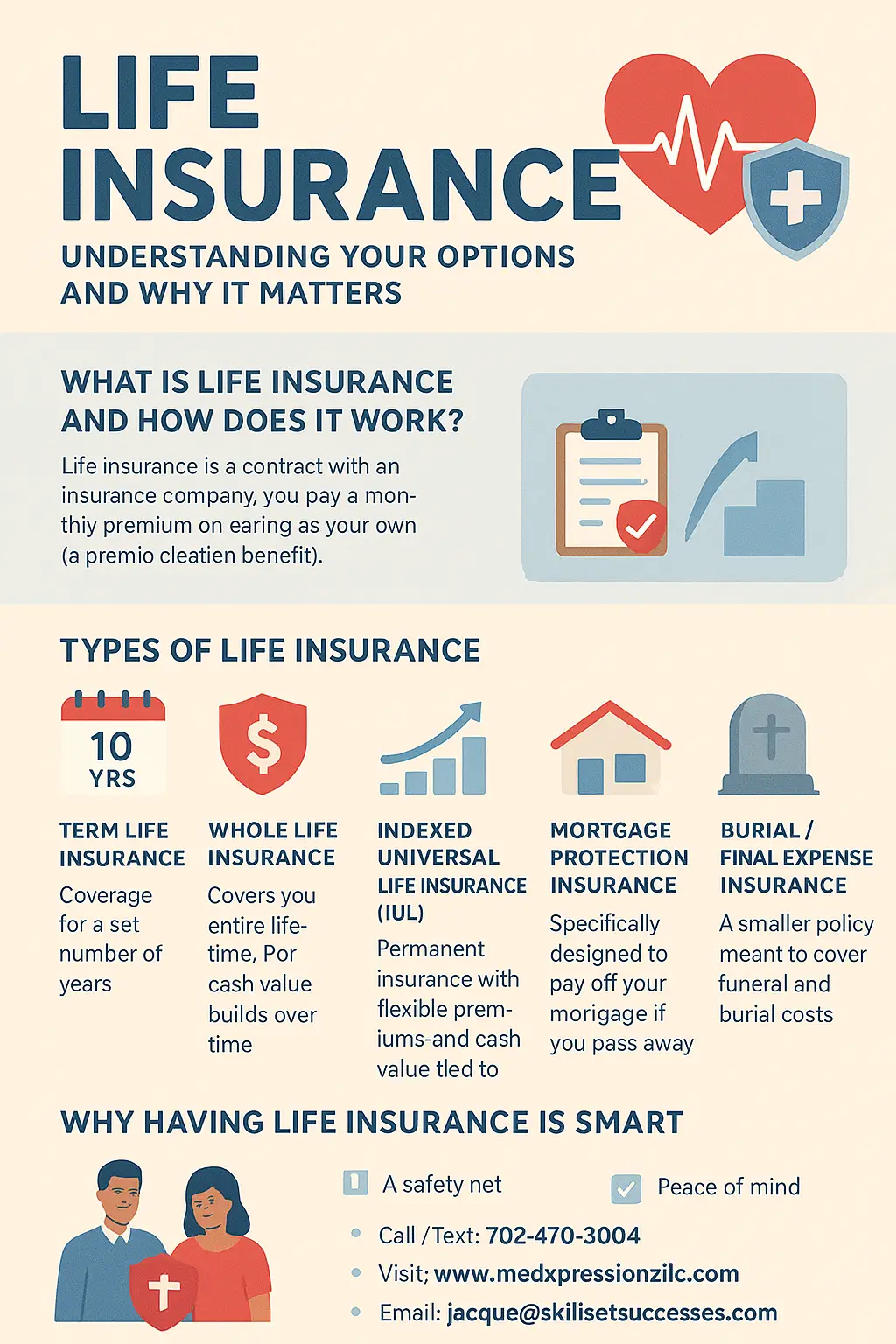

Life Insurance: Understanding Your Options and Why It Matters

Life insurance isn’t the most exciting topic—but it’s one of the most important financial tools you can have. At its core, life insurance provides financial protection for your loved ones if something happens to you. It helps cover expenses, replace lost income, and ensure your family doesn’t carry the burden of unexpected costs.

Let’s break down the different types of life insurance and how they work, so you can make an informed decision.

What Is Life Insurance and How Does It Work?

A life insurance policy is a contract with an insurance company: you pay a monthly premium, and in return, the insurer promises to pay a lump sum (called a death benefit) to your beneficiaries when you pass away.

This money can help cover bills, funeral expenses, mortgage payments, or simply provide financial stability for your family.

Types of Life Insurance

1. Term Life Insurance

-

Provides coverage for a set number of years (10, 20, or 30 years).

-

Affordable, straightforward option.

-

If you pass away during the term, your beneficiaries receive the payout.

-

If the term expires and you’re still alive, the coverage ends unless renewed.

✅ Great for: Young families, income replacement, mortgage protection.

2. Whole Life Insurance

-

Covers you for your entire lifetime as long as premiums are paid.

-

Builds cash value over time, which you can borrow against.

-

Premiums are higher but fixed.

✅ Great for: Long-term planning, wealth transfer, or those wanting lifelong coverage.

3. Indexed Universal Life Insurance (IUL)

-

Permanent life insurance with flexible premiums.

-

Builds cash value tied to a market index (like the S&P 500).

-

Can be used to supplement retirement income.

✅ Great for: People who want life insurance and an investment component.

4. Mortgage Protection Insurance

-

Specifically designed to pay off your mortgage if you pass away.

-

Ensures your family can stay in the home without financial stress.

✅ Great for: Homeowners who want peace of mind for their family.

5. Burial / Final Expense Insurance

-

Smaller policies meant to cover funeral and burial costs.

-

Easy to qualify for, even with health issues.

-

Coverage amounts are lower but enough to handle end-of-life expenses.

✅ Great for: Seniors or anyone who doesn’t want loved ones burdened with funeral bills.

Why Having Life Insurance Is Smart

Think of life insurance as a safety net. No one plans to leave their family unprotected—but life is unpredictable. Having coverage means your loved ones won’t have to scramble financially during an already difficult time.

Example Scenarios:

-

A young parent with a term policy ensures that if something happens, their kids’ college tuition and household expenses are covered.

-

A homeowner with mortgage protection ensures their spouse can keep the house.

-

A senior with a burial policy lifts the financial burden of funeral expenses from their children.

What About Work Policies?

Many employers offer life insurance as part of their benefits package, which is great—but here’s the catch:

-

Coverage often ends when you leave the company.

-

Employer-provided coverage is usually limited (often 1–2x your annual salary).

-

If you change jobs or retire, you could be left without protection.

👉 That’s why it’s important to have your own policy outside of work.

How to Get Started

Life insurance is not one-size-fits-all. The best option depends on your goals, age, health, and financial situation.

I can walk you through the options and help you find a policy that makes sense for you and your family.

📞 Call/Text: 702-470-3004

🌐 Visit: www.medxpressionzllc.com

📧 Email: jacque@skillsetsuccesses.com

✨ Bottom line: Life insurance is about love, protection, and peace of mind. Don’t wait until it’s too late—make the smart choice today.

Discover more from The Growth Blueprint

Subscribe to get the latest posts sent to your email.